The GGR for the quarter was € 191.68 million, which implies an increase of 7.48% quarter over quarter and 5.43% year over year.

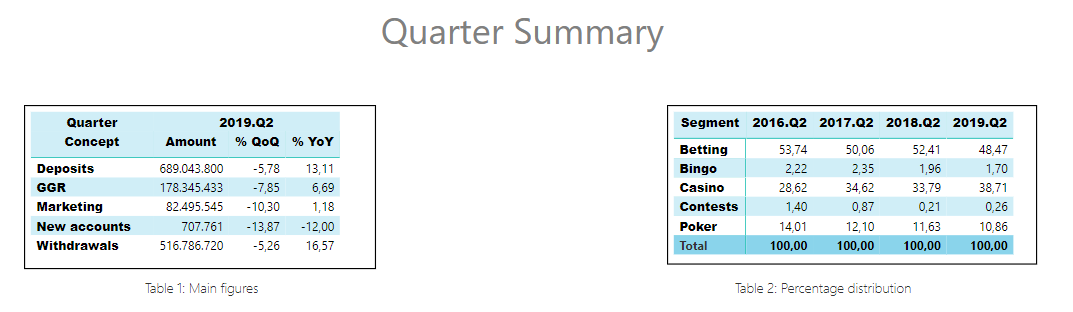

Regarding the rest of the main figures, deposits and withdrawals of the players, their variation rates decrease in relation to the previous quarter. Marketing expenditure increases very slightly 0.16% quarter over quarter and new accounts experiences a growth both with respect to the same quarter of the previous year and with respect the previous quarter, with the detail shown in Table 1.

In the analysis of the GGR by game segments it is observed that:

The € 191.68 million of GGR are distributed among € 100.77 million in Betting (52.47%); € 3.18 million in Bingo (1.66%); € 66.53 million in Casino (34.71%); € 0.73 million in Contests (0.38%) and € 20.48 million in Poker (10.68%).

The betting segment has a growth rate of 16.56% quarter over quarter and of 3.20% year over year. There is an increase of 2.84% in In-played sportsbook 43.94% in pre-match with respect to the previous quarter.

Bingo has experienced an growth of 4.98% quarter over quarter and 1.06% year over year.

In the casino segment there has been a decline of -3.62% quarter over quarter and an annual variation rate of 9.26%. This growth is mainly due to the slots. Since its launch in 2015 slots has led to increasingly higher market shares of the casino (see Table 2).

The contests experienced an increase of 54.52% in this quarter and a growth of 128.23% in the annual variation rate. This segment exhibits an irregular behaviour with annual variation rates in the third quarter of 281.65% in 2016; 25.51% in 2017; -85.02% in 2018. The overall result is that the market share of this segment with respect to the rest is decreasing.

The poker presents this quarter an increase of 5.77% over the previous quarter and 3.36% year over year. The increasing is mainly due to poker tournament that registers a positive quarterly variation rate of 12.36%.

As a summary, the percentage distribution of the GGR for the different segments in this quarter of the period from 2016 to 2019 is shown in Table 2.

Marketing spending has been € 82.3 million in the last quarter, with an annual growth of 6.05% and broken down into € 9.60 million affiliation expenses; € 5.46 million sponsorship; promotions € 31.73; and advertising € 35.46 million. There has been a variation of 0.16% quarter over quarter, motivated by the increase of sponsorship (45.65%) and affiliates (10.50%) and a decreasing of advertising (-12.38%)

The monthly average of active game accounts is 869.499, which implies an increase of 0.96% year over year. The monthly average of the new game accounts is 253.678, with an annual growth of 7.53%.

For this quarter, there are 80 licensed operators and the number of active operators by segment is:

- Betting: 37

- Bingo: 3

- Casino: 42

- Contests: 2

- Poker: 9

The most relevant fact for this quarter is the commercial lunch of 5 operators of the 30 new ones which were granted with a license since May 2019.