The GGR for the quarter was € 350.69 million, an increase of 11.23% quarter over quarter and 15.14% year over year.

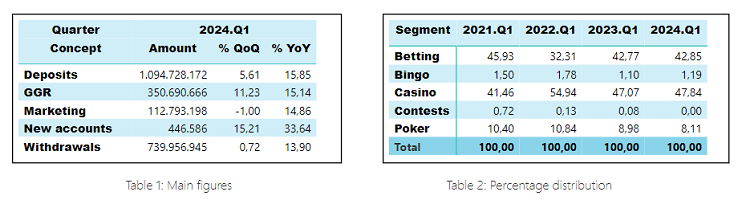

Regarding the rest of the main figures, deposits and withdrawals of the players, their variation rates rise in relation to the previous year, 15.85% and 13.90% respectively. With regard to previous quarter, deposits grow 5.61% and withdrawals 0.72%. Marketing expenditure decreases -1.0% quarter over quarter and new accounts experiences a growth with respect to the previous quarter, 15.21%. Details are shown in Table 1.

In the analysis of the GGR by game segments, it is observed that:

The € 350.69 million of GGR are distributed among € 150.28 million in Betting (42.85%); € 4.19 million in Bingo (1.19%); € 167.76 million in Casino (47.84%); € 0.002 million in Contests (0.00%) and € 28.45 million in Poker (8.11%).

The betting segment has a positive variation rate of 30.99% quarter over quarter and 15.37% year over year. There is an increase with respect to the previous quarter in pre-match, 588.84% and a decrease of in-played sportsbook, -31.69%. Other bettings increases 1.57% this quarter, and horse betting decreases -28.36%.

Bingo has experienced a growth of 9.18% quarter over quarter and 24.93% year over year.

In the casino segment, there has been a decline of -2.05% quarter over quarter and an annual variation rate of 17.02%. Slots has increased 14.98% and life roulette 22.19% year over year. Quarter over quarter, BlackJack, conventional and life roulette have growth 7.32%, 9.69% and 6.37%, respectively. On the other hand, slots fall -7.51%.

Contests experienced a fall of -96.79% quarter over quarter and -99.38% year over year. This segment continues an irregular behaviour with annual variation rates in the first quarter of -7.59% in 2021; -85.15% in 2022; -4.89% in 2023.

Poker presents a growth of 11.98% quarter over quarter and 3.99% year over year. Poker tournament had a positive variation rate of 11.19% quarter over quarter and 2.04% year over year. Poker cash increases 13.91% compared to the previous quarter and 8.91% compared to the same quarter of the previous year.

As a summary, the percentage distribution of the GGR for the different segments in this quarter of the period from 2021 to 2024 is shown in Table 2.

Marketing expenses has been € 112.79 million in the last quarter. It may be broken down into € 14.27 million affiliation expenses; € 1.07 million sponsorship; promotions € 55.67; and advertising € 41.78 million. Compared to the previous quarter, marketing expenses declines -1.00% and increases 14.86% in annual variation. Quarter over quarter, Sponsorship decreases -12.55%; Affiliates -0.87%; Advertising -7.68% and Promotions increases, 4.93%. Year over year, Sponsorship decreases -27.23%; Affiliates increases 14.82%; Advertising increases 22.49% and Promotions, 10.92%. Promotions are broken down into cost of bonus included in prizes, € 22.23 million and cost of bonus not included in prizes, € 33.44 million.

The monthly average of active game accounts is 1,327,575; which implies an increase of 4.57% quarter over quarter and an increase of 14.58% year over year. The monthly average of the new game accounts is 148,862; with a growth of 15.21% quarter over quarter and 33.64% year over year.

For this quarter, there are 78 licensed operators and the number of active operators by segment is:

- Betting: 41

- Bingo: 4

- Casino: 50

- Contests: 2

- Poker: 9

Temas relacionados:

If you want look for any news, you can use the News Searcher