Publication of the annual report on national online gambling market 2018. This report, a compendium of the quarterly online gambling reports published by the DGOJ, is a step prior to the publication of the Spanish Gambling Market Data.

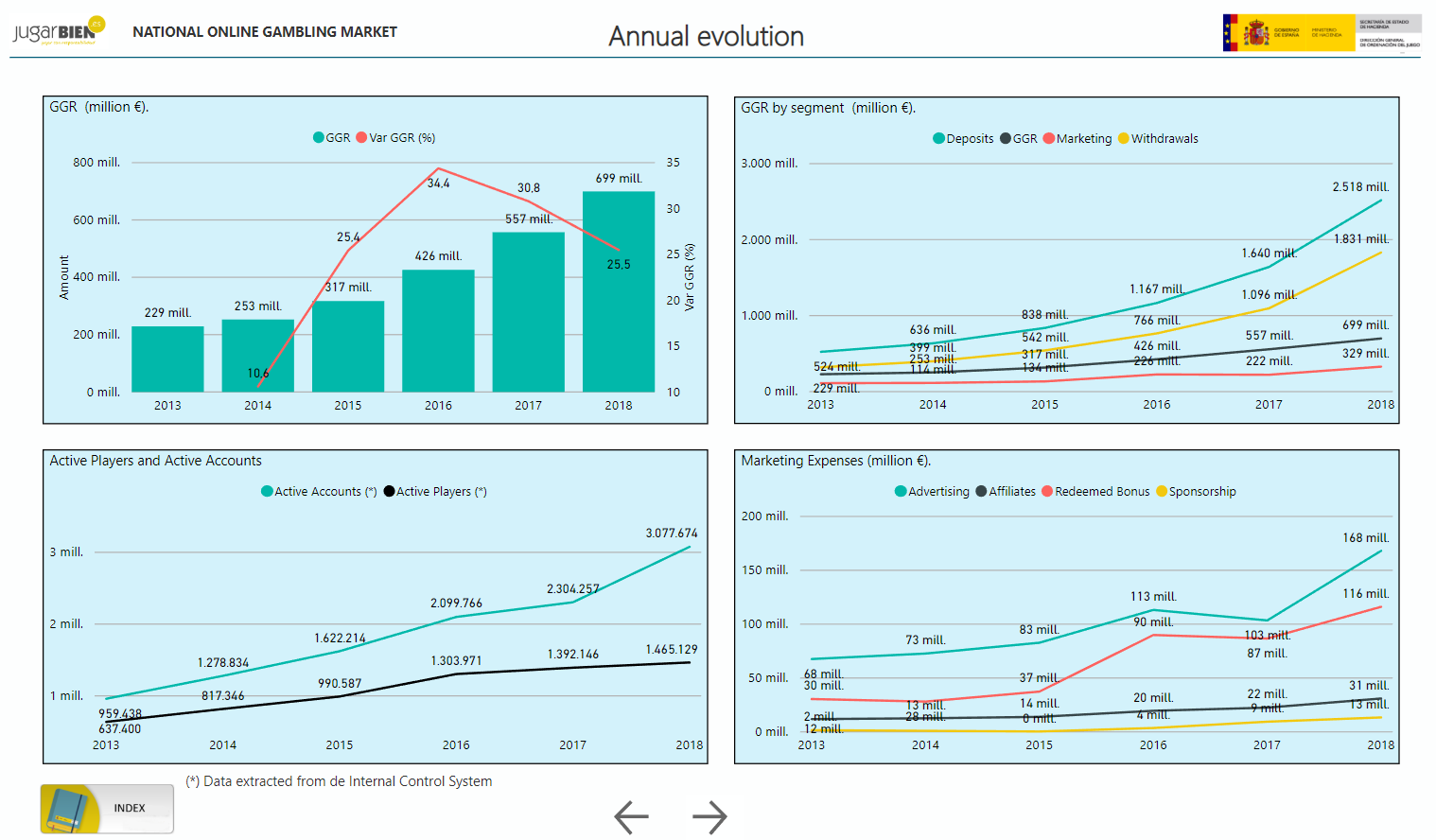

The GGR of 2018 was € 699 million, up 25.48% year over year.

Deposits and withdrawals maintains an upward trend, with an increase of 53.50% and 67.01% year over year respectively.

Marketing expenditure of 2018 was € 328 millions, up 48% with respect to the previous quarter, due to the growth of advertising and promotions.

The active gamblers was 1,465,129, up 5.24% year over year.

In the analysis of the GGR by game segments it is noticed that:

The € 699 million of GGR are distributed in € 365.1 million in Betting (52.20%); € 13.4 million in Bingo (1.92%); € 237.9 million in Casino (34.03%), € 1.0 million in Contests (0.15%) and € 81,8 million in Poker (11.70%).

The betting segment had a growth rate of 18.11% year over year. The rise was due to pre-match sportbetting, 24.69% year over year, and in-played sportbetting, 14.93% year over year. Pre-match represents 41.59% of the betting segment while In-played represents 55.92%.

Bingo has experienced a gain of 17.40% with respect to the previous year keeping the trend initiated in 2016.

In the casino segment underwent the biggest growth, 38.91% with regard to 2017. This situation comes from 2015, with annual rise of 72.49% in 2016 and 47.21% in 2017. This growth was mainly due to the slots. Since its launch in 2015 slots has led to increasingly higher market shares of the casino. In 2018 slots represents 54.73% of the casino segment, up 50.62% year over year. Life Roulette, Conventional Roulette and Black Jack also grew significantly, 33.38%, 24.21% and 20.16% respectively. Baccarat fell -64.80% regarding previous year and other games like complementary games disappeared.

The contests experienced in 2018 a drop of -82.15%. The overall result is that the market share of this segment with respect to the rest is decreasing. It represents only 0.15% of the global gambling market.

The poker presents an increase of 37.05% year over year. Poker tournament had a rise of 44.45% with regard to 2017 and represent 62.5% of the poker market. Poker cash grew up 26.28% year over year.

Marketing spending in 2018 has leapt € 328 million, broken down into € 30.9 million affiliation expenses; € 13.4 million sponsorship; promotions € 116.1; and advertising € 168.1 million.

The monthly average of active game accounts is 833,525, which implies a growth of 28.35% with respect to the same quarter of the previous year. The monthly average of the new game accounts is 256,008, with an annual increase of 20.79%.

The most relevant fact from the regulatory point of view, is the opening of share liquidity for poker, with France and Portugal. Along 2018, four poker platforms have had shared liquidity with these countries.

Temas relacionados:

If you want look for any news, you can use the News Searcher